Investing in a secure and reliable financial instrument is a priority for many individuals who wish to grow their savings without taking excessive risks. Among the options available in India, Post Office National Savings Certificates (NSC) have consistently emerged as a preferred choice for conservative investors. With the right approach, you can see substantial growth in your investment over a period of five years.

What Are Post Office National Savings Certificates?

National Savings Certificates (NSC) are fixed-income investment instruments offered by the Indian Post Office. They are backed by the government, which makes them virtually risk-free. NSC is popular for several reasons: it provides guaranteed returns, tax benefits under Section 80C, and a simple process for investment and redemption.

NSCs are available in different tenures, but the most common is the 5-year certificate. Investors can choose to invest in multiples of ₹100, and there is no upper limit for investment, making it accessible for both small and large investors.

Why NSC Is a Safe Investment Choice

Safety is the key reason many investors turn to NSC. Since it is government-backed, your principal investment is fully secure, unlike stocks or mutual funds which carry market risks. Furthermore, the interest is compounded annually but payable at maturity, allowing your money to grow steadily over time.

Another advantage is the tax-saving feature. The amount you invest in NSC qualifies for a deduction under Section 80C, up to a limit of ₹1.5 lakh per year. This reduces your taxable income and effectively increases your returns.

Understanding NSC Interest Rates and Compounding

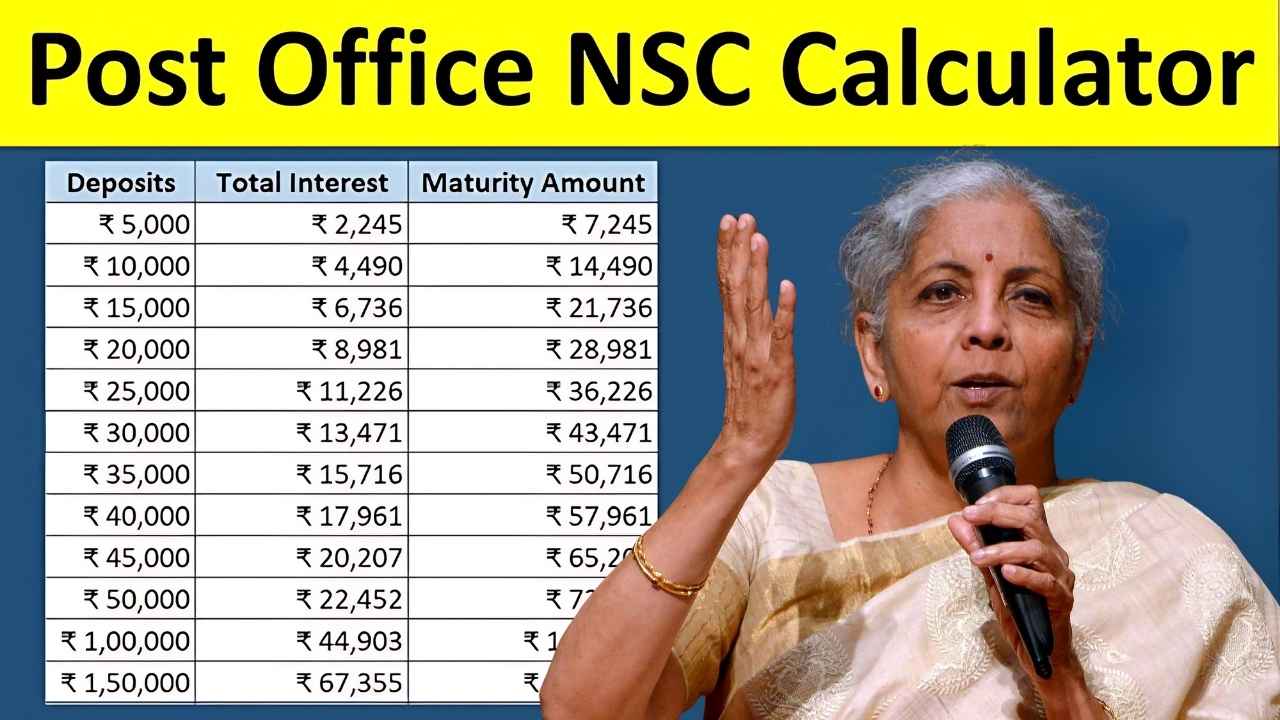

The growth of your investment in NSC primarily depends on the prevailing interest rates. As of now, the 5-year NSC offers an annual interest rate of around 8%, compounded annually. This compounding effect is crucial as it allows your investment to grow exponentially over the term.

For example, if you invest ₹10 lakh in a 5-year NSC at 8% annual interest, by the end of the term, your investment can grow close to ₹14.7 lakh. By increasing your investment over multiple certificates and leveraging tax savings, it is possible to accumulate a corpus nearing ₹58 lakh in five years.

How to Plan Your Investment to Reach ₹58 Lakh

Reaching a goal of ₹58 lakh in five years requires careful planning. First, you need to determine the total capital you are willing to invest each year. Since NSC allows multiple investments, you can spread your funds across different certificates to manage liquidity and interest compounding effectively.

For instance, if you start with an initial investment of ₹10 lakh and continue investing approximately ₹8–10 lakh each year, reinvesting the interest earned, your total corpus can compound to nearly ₹58 lakh by the fifth year. The key is consistency and allowing each certificate to mature fully to maximize returns.

Tax Benefits to Boost Your Returns

NSC is not just a safe investment but also tax-efficient. The investment amount qualifies for a deduction under Section 80C, while the interest earned every year is taxable but compounded, which makes it easier to manage. For high-income taxpayers, this combination of safety, interest, and tax benefits makes NSC an attractive choice to grow wealth systematically.

How to Invest in NSC

Investing in NSC is simple. You can visit your nearest post office and fill out the NSC application form. You will need basic documents like identity proof and address proof. Payments can be made in cash, cheque, or demand draft. Once invested, the certificates are issued immediately, and your investment starts earning interest from the date of purchase.

NSCs can also be purchased online through the Post Office Savings portal for greater convenience. This reduces paperwork and allows you to track your investments easily.

Tips for Maximizing Returns

- Start Early: The earlier you invest, the more time your money has to compound.

- Reinvest the Interest: Allow your interest to compound by reinvesting in new certificates upon maturity.

- Diversify Investments: While NSC is safe, consider spreading your investments across other government-backed instruments to balance returns and liquidity.

- Plan Tax-Saving: Invest strategically to maximize Section 80C benefits each year without exceeding the limit.

Conclusion

Post Office NSC schemes offer a rare combination of safety, guaranteed returns, and tax benefits. With disciplined and systematic investment, it is possible to grow your savings to nearly ₹58 lakh in five years. The key lies in understanding the compounding power, planning yearly investments, and leveraging the tax benefits efficiently. For conservative investors looking to secure and grow their money without exposure to market risks, NSC remains an excellent option.